CAR

PROBLEMS

CAR

PROBLEMS

You have the right to get what you paid for but you should act quickly. Car problems can be complex to deal with, and there are time limits for legal action.

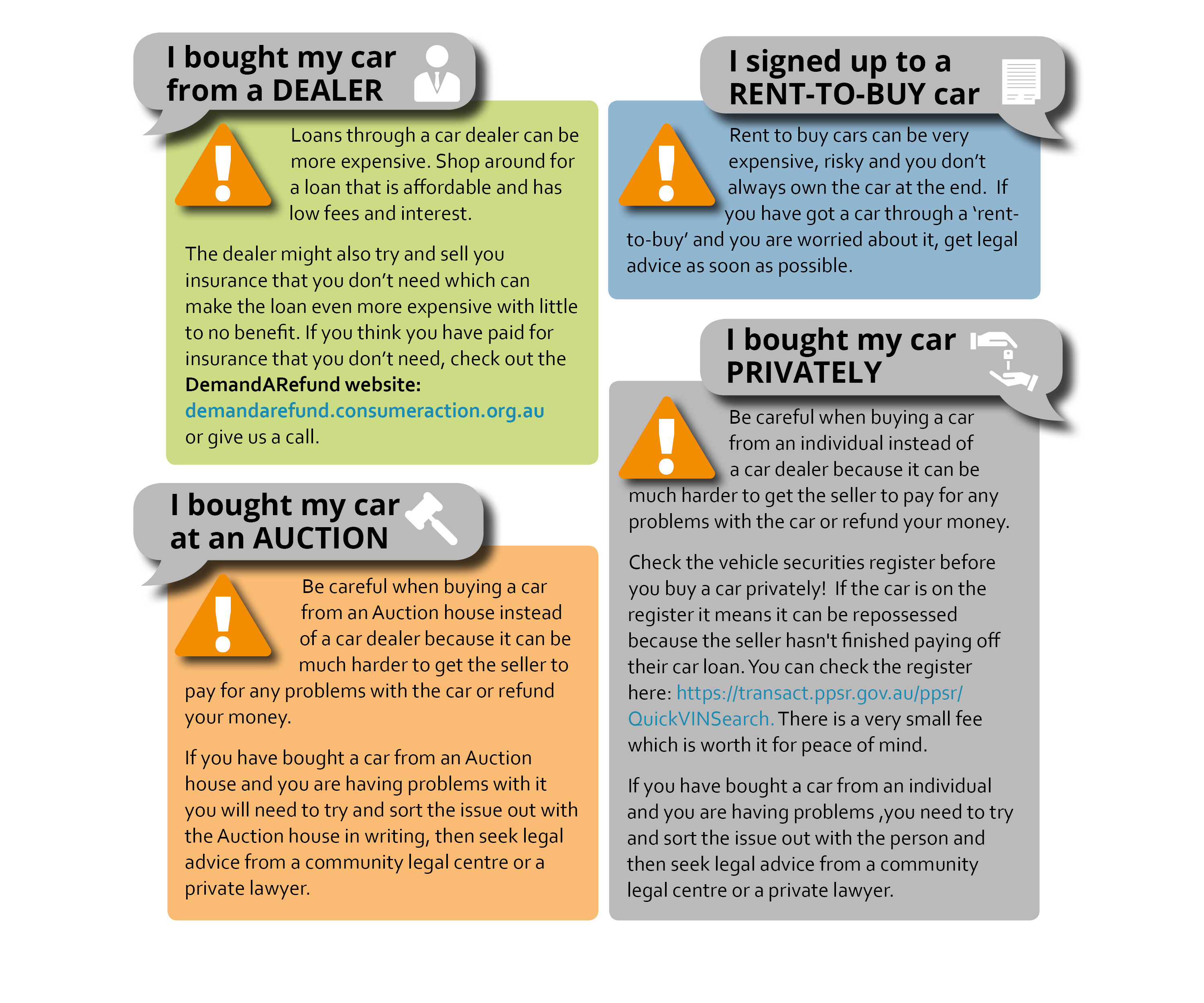

I bought my car from a DEALER

Loans through a car dealer can be more expensive. Shop around for a loan that is affordable and has low fees and interest.

The dealer might also try and sell you insurance that you don’t need which can make the loan even more expensive with little to no benefit. If you think you have paid for insurance that you don’t need, check out the DemandARefund website or give us a call.

I signed up to a RENT-TO-BUY car

Rent to buy cars can be very expensive, risky and you don’t always own the car at the end. If you have got a car through a ‘rent-to-buy’ and you are worried about it, get legal advice as soon as possible.

I bought my car at an AUCTION

Be careful when buying a car from an auction house instead of a car dealer because it can be much harder to get the seller to pay for any problems with the car or refund your money.

If you have bought a car from an auction house and you are having problems with it you will need to try and sort the issue out with the auction house in writing, then seek legal advice from a community legal centre or a private lawyer.

I bought my car PRIVATELY

Be careful when buying a car from an individual instead of

a car dealer because it can be much harder to get the seller to pay for any

problems with the car or refund your money.

Check the Vehicle Securities Register before you buy a car privately! If the car is on the

register it means it can be repossessed because the seller hasn’t finished paying off their car loan. You can check the register here:. There is a very small fee which is worth it for peace of mind.

If you have bought a car from an individual and you are having problems, you need to try and sort the issue out with the person and then seek legal advice from a community legal centre or a private lawyer.

LUKE & RHONDA'S STORY

Luke and Rhonda have 5 kids. Luke was working full-time as a labourer earning about $950 per week. Rhonda was not working and was receiving Centrelink benefits of about $467 per week.

In May 2016, Luke and Rhonda went to a car yard in Melton, Victoria to buy a car. They signed a car sale contract and paid a deposit of $1,000. When they signed the car sale contract, the dealer arranged for Luke and Rhonda to get a loan from a bank for $20,000. Luke and Rhonda didn’t know that they were also sold loan insurance, gap insurance and tyre and rim insurance and that this added to the overall amount they had to repay under the loan.

Around August 2017, the car broke down and Luke and Rhonda couldn’t afford to fix it. Luke and Rhonda contacted Consumer Action for assistance.

The loan application documents showed that the bank knew that Luke and Rhonda didn’t earn very much at the time of the loan, and that they had 5 kids to support. The only expense listed on the loan application was their rent. As well as being unable to use the car, they were also struggling to make the repayments under the loan which was unaffordable for them.

With Consumer Action’s help, they were able to return the car and settle their dispute with the bank and the insurance company.

You have legal rights that a car bought from a car dealer will:

You have legal rights even if you don’t have a warranty from the company or it doesn’t cover the problems with your car